Health Insurance Basics

Plan vs Network

Your plan outlines your medical coverage, and your network determines which doctors, clinics, and hospitals you visit for in-network healthcare. Make sure to visit healthcare providers in your network to maximize your PEHP benefits and avoid overpaying for your care. See a list of doctors, clinics, and hospitals in your network in the PEHP Provider Directory. Both your plan and network are listed on your PEHP ID card.

- Premium – The amount you pay for your health insurance each paycheck. Remember, this is deducted from your paycheck whether you go to the doctor or not. Want a lower or no premium medical plan? Consider enrolling in a high-deductible health plan, such as the STAR HSA Plan.

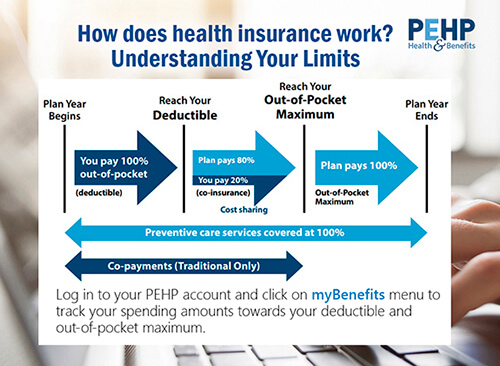

- Deductible - The amount you must first pay before PEHP begins to pay its coinsurance portion of your claims.

- Copay – Set dollar amount you pay for a service. This amount is applied to the out-of-pocket maximum but is not applied to the deductible. Copays are only available on Traditional Plans.

- Coinsurance - A percentage of the cost you pay for most medical services once the deductible is met and until you’ve reached the out-of-pocket maximum.

- Out-of-Pocket Maximum (OOPM) - The maximum amount your household pays for covered services in a plan year after which PEHP pays 100% for covered benefits at an in-network provider. For plans with an out-of-network benefit, PEHP pays 80% of the in-network rate for covered services at an out-of-network provider.

Your Benefits Guide/Summary contains details specific to your plan, including benefit grids that show what's covered and what isn't and how much your benefits pay.

Your Master Policy contains terms and conditions for using your benefits, including limitations and exclusions.

Log in to your PEHP account:

- Go to the "My Benefits" menu

- Find "Benefit Summaries"

- Choose the "Benefits Summary" or "Master Policy" folder to find documents specific to your benefits

A claim is a detailed invoice that your health care provider (such as your doctor, clinic, or hospital) sends to PEHP to collect payment for services you received. This invoice shows exactly what services you received. You can view your claims when you log in to your PEHP account and navigate to Claims History under the My Benefits menu.

An exclusion is a specific condition, circumstance, or prescription for which PEHP will not cover. Log in to your PEHP account to see a list of exclusions in your Master Policy (click "Benefit Summaries" under the "my Benefits" menu).

The In-network rate is the discounted price that providers in your network have agreed to charge for services. Based on your benefits, you may be required to pay some portion of the in-network rate. Your Benefits Summary describes your member cost-sharing as a portion of the In-Network Rate.

Balance billing happens when an out-of-network provider charges more than the PEHP in-network rate. If you go out-of-network for services, you may be billed the full amount the provider charges because PEHP has no pricing agreements with out-of-network providers. Nothing you pay for balance billing counts toward your deductible or out-of-pocket maximum.

How can you avoid balance billing? First, make sure every person and every facility involved in your care is in your medical or dental network. Find in-network providers in the PEHP Provider Directory.

If you can’t avoid seeing an out-of-network provider, consider negotiating a price beforehand. It can help to know the in-network fee, which you can find using the cost tools available in your PEHP account.

Request to have a provider added to your network by filling out this form.

Some medical services and prescriptions require preauthorization before you receive treatment. To get preauthorization, your doctor must call PEHP (801-366-7555). Most doctors know how and when to do this, but it's your responsibility to verify. Otherwise, your benefits could be reduced or denied.

Learn More.

When you seek care, your provider will send a bill to PEHP for payment of services. We send you an Explanation of Benefits (EOB) each time we process a claim for you or someone on your plan. The EOB is not a bill – it’s a summary of how your benefits apply to the service(s) you received.

In a nutshell, this is what the EOB tells you:

Billed Amount: The amount the provider charges for the service.

Allowed Amount: The contracted rate PEHP has with in-network providers.

Plan Paid: The amount PEHP is responsible to pay based on your cost sharing (coinsurance) plan. For example, your plan may pay 80% of the bill (after you meet your deductible) and you may pay 20%.

Your Responsibility: The amount you are responsible to pay the provider after PEHP has paid its portion.

To see your EOBs online, log in to your PEHP account and click on Claims History under the My Benefits menu. If you believe there is an error in your EOB, please contact us immediately via the Message Center in your PEHP account or call us at 801-366-7555.

Open Enrollment is the only time during the year that you can change your PEHP benefits and get additional coverage for you and your family for the upcoming plan year. Check with your employer to see when Open Enrollment is available to you. The only other time you can add or remove coverage during the year is if you have a MIDYEAR EVENT, such as a new baby, adoption, marriage, divorce, or loss of other insurance coverage.

Changes to who you cover on your plan can be made anytime during the year when it coincides with a Midyear Event – birth or adoption of a child, marriage, divorce, dependent reaches age 26, retirement, or Medicare enrollment. It’s important to notify PEHP immediately when you have a Midyear Event as there is a limited window to make these updates. Call us at 801-366-7555 or use the secure Message Center in your PEHP account.

When you’re covered by two or more insurance plans, PEHP uses state guidelines to determine which plan pays your claims first. For example, your employer’s plan is primary for your claims and your spouse’s plan is secondary. The primary plan covers the major portion of eligible bills, and the secondary plan may cover any remainder. Double coverage does not stack coverage, but simply determines the sequence for paying a claim.

Coordination of benefits (COB) can be complex. Call us at 801-366-7555 and we can help you:

- Decide if you’re better on one plan or two.

- Understand how HSA rules apply to double coverage situations.

- Avoid getting stuck with medical bills due to confusion in coverages.

Remember to keep PEHP and any other insurance carrier informed when you or a family member add or lose insurance coverage. This helps ensure your claims are processed correctly to avoid unnecessary charges.